The basics of working capital financial products: enhancing cashflow

It can be challenging to keep adequate cash in the bank, especially when you’re growing rapidly or experiencing sales volatility. Working capital management is essential to running your business efficiently and paving the way for growth.

What is working capital?

Imagine you run a small company that designs and manufactures innovative pet toys. You need money to buy materials like rubber, rope and plastics to create your toys. You also need some cash to cover your employees’ wages, warehouse costs and utility bills.

The money you use to buy supplies and keep your business running day-to-day is your working capital, the assets a business uses for daily operations. It includes things like:

- Cash: Money in the bank that you can use immediately.

- Accounts receivable: Money that customers owe you for products or services you’ve already delivered.

- Inventory: Products or supplies you have on-hand that you plan to sell.

The importance of working capital

Working capital is crucial for several reasons:

- Liquidity measurement: It provides a snapshot of a company’s liquidity, indicating its ability to cover short-term obligations with short-term assets.

- Operational efficiency: Adequate working capital allows a company to continue operations and meet financial obligations without external funding.

- Financial health indicator: Positive working capital indicates a company’s ability to invest in growth opportunities and sustain operations, while negative working capital may signal potential liquidity problems.

Working capital in action

Let’s say your business has $20,000 in cash, $30,000 in raw materials and finished inventory and $50,000 in outstanding invoices from pet stores. This adds up to $100,000 in current assets. If you owe $40,000 for a recent shipment of materials and $10,000 in other bills, your current liabilities are $50,000. So, your working capital would be:

$100,000 − $50,000 = $50,000

This means you have $50,000 to run your pet toy business smoothly.

Why is working capital management so important?

Now, your pet toy company has grown into a national supplier for major pet store chains. Your brand is growing, but you’ve recently been feeling a strain on cash. You have a new eco-friendly rubber supplier who doesn’t offer the same trade credit. Your biggest customer has paid you 30 days late on their last two orders. You’re asking yourself, “Why do I never have any money?”

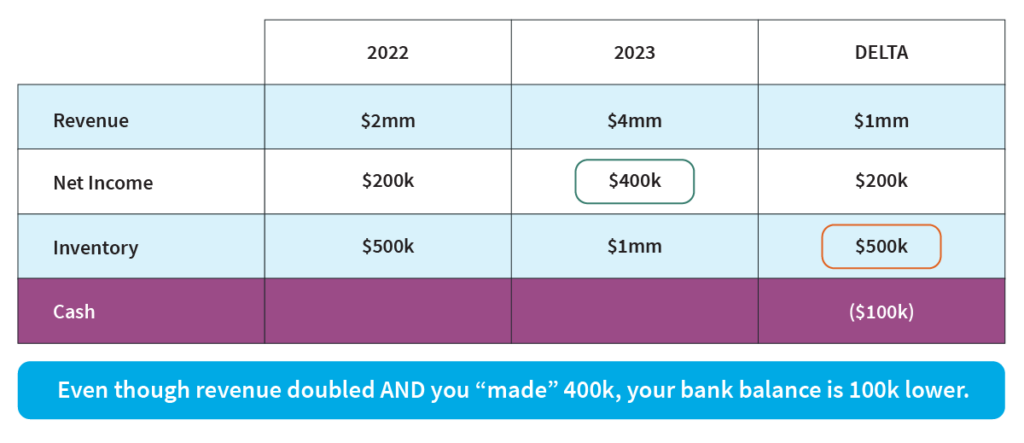

You talk things through with your accountant. In 2022, you made $200k on $2mm in sales. Last year, the business doubled, bringing in $400k on $4mm in sales. But you’ve noticed that even though you “made” $400k in accounting profit, your bank balance has shrunk!

You’ve discovered how important it is to pay attention to cash flow. Your asset accounts, including your inventory and accounts receivable, can outweigh your growing liability accounts, like credit card balances and accounts payable. When the bulk of those assets are non-cash, you end up in a situation where your bank account is empty when you need cash most.

This is especially true for businesses with growing inventory! The most challenging part of scaling any business that holds inventory is making sure you have the cash to power the growth of your asset accounts.

How do you solve this?

It’s critical, especially as you work to continue scaling your business, to offset the growth in current assets with current (or short-term) liabilities. This includes a toolkit of strategies—from negotiating longer trade credit with your suppliers, to taking purpose-built working capital loans, to putting some expenses on credit cards. For a small- to medium-sized business, working capital financial products provide the liquidity to cover day-to-day expenses, invest in new opportunities and navigate periods of fluctuating cash flow.

Working capital financial products

Working capital financial products encompass a range of solutions aimed at improving a company’s liquidity and overall financial health. These products include lines of credit, short-term loans, trade credit and accounts receivable financing.

Each of these tools serves a specific purpose in helping businesses manage their cash flow and access the necessary funds to operate efficiently. For brands, maintaining adequate working capital is essential to meet the demands of retailers and keep the supply chain moving seamlessly.

- Lines of credit: A line of credit provides businesses with access to a predetermined amount of funds that can be drawn upon as needed. This flexibility is ideal for covering unexpected expenses or bridging gaps between accounts receivable and payable.

- Short-term loans: These loans offer a lump sum of cash that businesses can use for various purposes, such as purchasing inventory or investing in equipment. Repayment terms are typically shorter, making them suitable for immediate financial needs.

- Trade credit: Suppliers often extend trade credit to their customers, allowing them to purchase goods or services with deferred payment terms. This arrangement can help businesses manage their cash flow by delaying outgoing payments while still fulfilling orders.

- Invoice financing: Invoice financing involves borrowing against outstanding invoices in exchange for immediate cash. This product is particularly beneficial for businesses that have long payment cycles but need flexible access to funds.

How does SPS Commerce help?

SPS now offers Invoice Financing powered by Kanmon* for US-based suppliers. Our goal is to provide a flexible option that gives suppliers the liquidity needed to meet retailer demands, invest in growth opportunities and maintain a competitive edge. Integrating invoice financing can significantly improve financial operations and cash flow management. Here’s how:

- Automated invoicing: Our solutions automate data interchange between suppliers and their retail customers to facilitate timely and accurate billing.

- Streamlined funding: Invoices are seamlessly transferred to Kanmon*, the financing provider, allowing for simple, quick access to funds.

- Continuous cash flow: Immediate funding from invoice financing helps support ongoing operations, financial obligations and growth without cash flow interruptions.

Wondering if invoice financing is right for your business? Explore our flexible financing solution and boost your cash flow today!

* Kanmon is a licensed commercial lender founded by a team with deep lending experience and backed by FIS Global, a Fortune 500 financial technology business. For more information about Kanmon, visit www.kanmon.com

- SPS Commerce Named #1 IT Infrastructure Software by G2 - February 25, 2025

- Optimizing RTV: The key to smarter supply chain management - January 6, 2025

- E-invoicing: all the basics you need to know - December 16, 2024

RELATED POSTS

What is a 2D barcode and how does it ...

Seeing clearly in a complex market

Retail data is your true north in a s...