Don’t let 30, 60, or 90-day invoice payment terms hold your business back. Maximize your cash flow with SPS Invoice Financing.

Get started with the enrollment process by signing into your SPS Commerce account. Or sign up to create an account in a few easy steps.

Accelerate your cash with SPS Invoice Financing

Unlock immediate cash flow from your unpaid invoices to access funds now, so you can cover expenses and fuel growth without waiting weeks or months for invoice payments. Streamline your cash management and enhance financial flexibility with our invoice financing solutions.

We carefully selected Kanmon, a licensed commercial lender backed by FIS Global, as our trusted partner in bringing this solution to our customers.

- Get funded early on eligible invoices

- Upload eligible invoices for any customer

- Stay in control of your retail relationships

How does SPS Invoice Financing work?

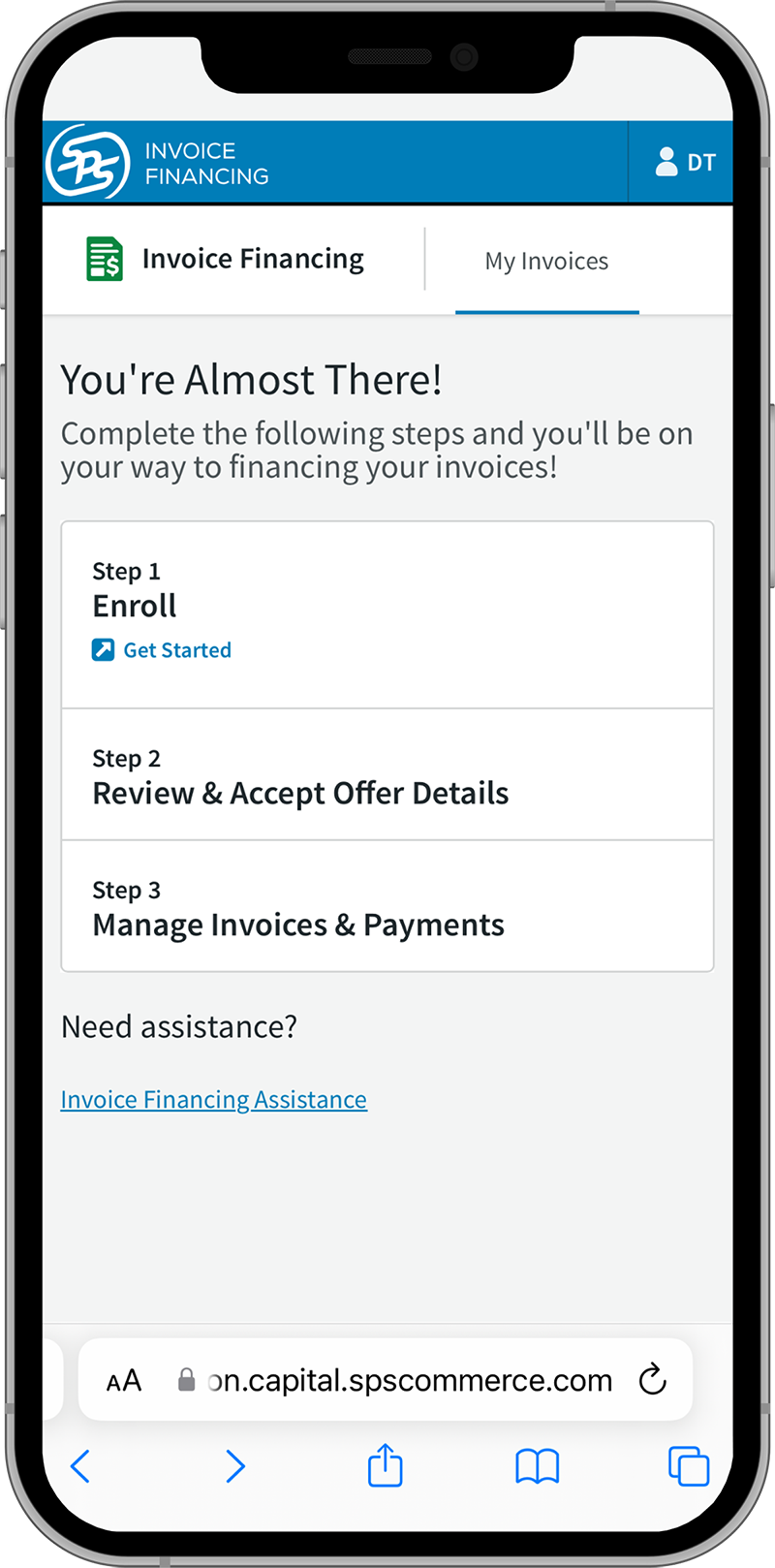

Get started with 3 simple steps:

- Enroll

Log into your existing SPS account, or sign-up and create an account to confirm eligibility. Enrollment must be completed by someone with an ownership stake in the company. Enrollment typically takes 10 minutes or less. - Get approved

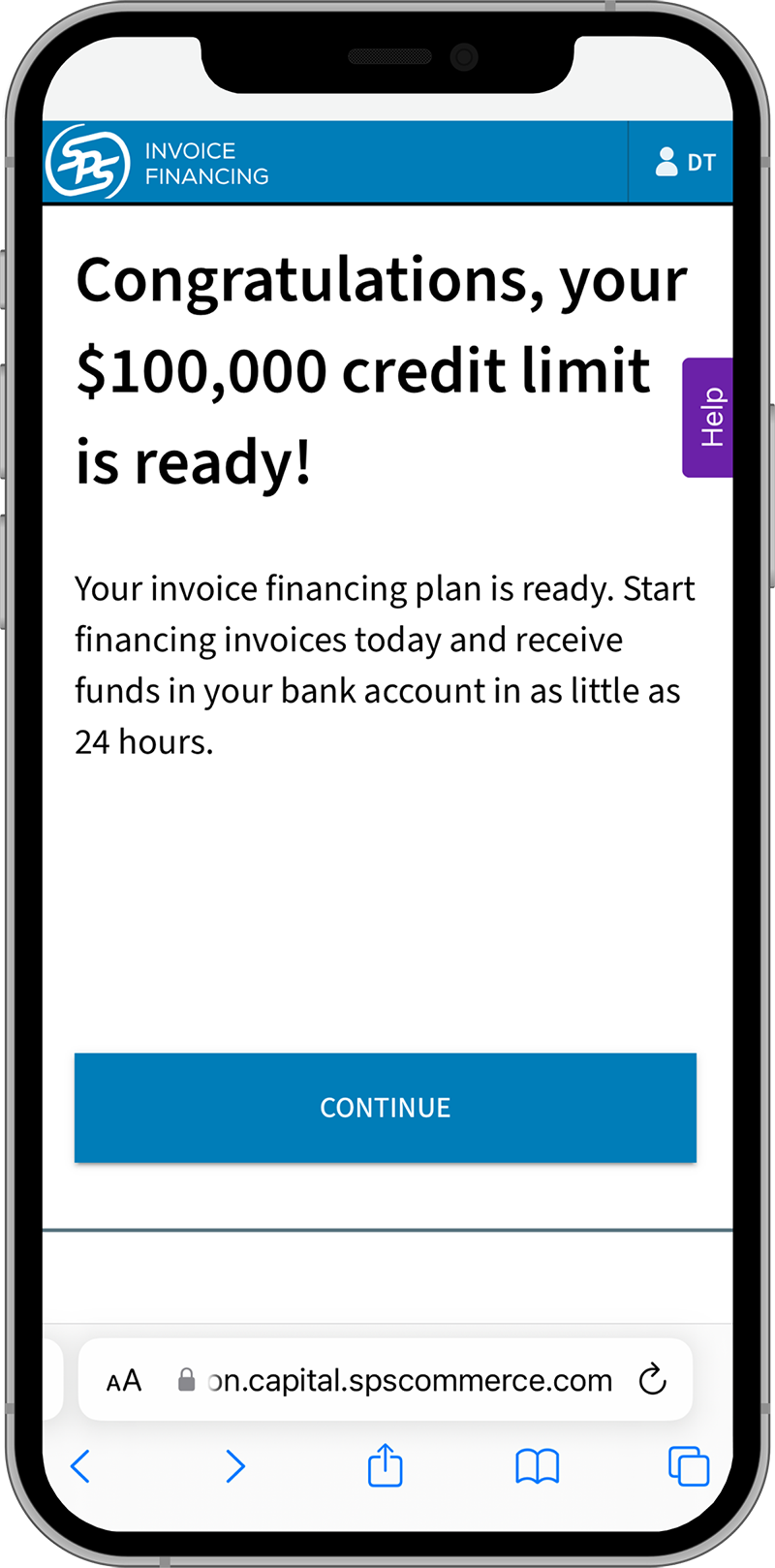

Get approved and get your credit limit (typically approved same day). - Get paid

Upload eligible invoices for any customer and get paid early.

Prefer to speak with someone over the phone?

Email us at invoicefinancing@spscommerce.com to set up a call.

Invoice factoring and invoice financing explained

Invoice financing and factoring both provide cash from unpaid invoices, but there are key differences.

| Invoice factoring | Invoice financing | |

| Accelerate cash flow | ✅ | ✅ |

| Involve a third-party lender | ✅ | ✅ |

| Business retains control over collecting payments | ❌ | ✅ |

| Business can finance invoices for any trading partner | ❌ | ✅ |

| Business chooses which invoices to finance | ❌ | ✅ |

So, I have several hundred thousand in receivables, and I’m out of cash right now. Well, I can take a few invoices, and in a couple of days, the money is there, and I don’t have to suffer and get an ulcer trying to line up cents. And all it took was minutes, because we had everything already on the platform. It was very easy to do and get started.

– Margarita Womack, Founder, Maspanadas

The basics of working capital financial products: Enhancing cash flow

A guide to managing your working capital, including strategies you can use now to boost your financial health.

How top suppliers overcome common cash flow challenges

Learn what leading brands and manufacturers are doing to offset payment delays, seasonal demand, unplanned expenses and more.

Unlock the power of invoice financing for seasonal demand peaks

Holidays and other peak buying seasons can stretch your cash flow, but there are new ways to keep your capital moving smoothly.

Accelerate growth with invoice financing

Whether expanding your footprint or bringing on new partners, invoice financing can make sure there are enough funds to take advantage.

Frequently Asked Questions

What is SPS Invoice Financing?

We understand how stressful it can be waiting weeks or months for retail customers to pay an invoice. SPS Invoice Financing empowers you to get paid early on your due invoices – not limited to certain invoices or customers – whether the invoices are sent through SPS Commerce or not. By using Invoice Financing with SPS Commerce, you can manage cash flow more effectively, allowing you to sustain and grow without being bottlenecked by delayed payment cycles.

Who is Kanmon?

SPS Invoice Financing is powered by Kanmon, a commercial financing company we’ve hand-selected to enable our customers to use invoice financing.

Kanmon is a licensed commercial lender founded by a team with deep lending experience and backed by FIS Global, a Fortune 500 financial technology business. For more information about Kanmon, visit www.kanmon.com.

How does Kanmon determine my credit limit and fees?

Kanmon Approved credit limits are based on a variety of factors related to your business, including your outstanding debt balance, business expenses and income, account history, payment frequency and more.

Along with your credit limit, Kanmon provides you with simple options for repayment terms and transparent fees associated with each repayment time frame. If you take an advance on an invoice that is due in up to 30 days, you’ll repay your funds in 30 days. If your invoice has longer terms, you may be able to select whether you’d like to repay your advance on a more flexible timeline.

For an invoice advance with repayment in 30 days, Kanmon’s fees typically range from 2%-4.5%. We are here to help you accelerate payments across any retailer you work with, while keeping you in control over your relationships with customers.

Once you’ve started, Kanmon periodically reviews your credit limit to help support any need for growth.

Does applying for the program affect my credit score?

No! The application process itself does not impact credit. Kanmon conducts a soft pull of your credit report, which does not affect your personal credit score.

Why do I need to provide my bank connection details?

Securely connecting your business bank account allows Kanmon to review your cash flow and determine your best invoice financing offers. Kanmon also automatically deducts repayment from the account you’ve connected.

My business uses SPS, but I don’t have a login myself. Is there a way for me to sign up?

Yes! Simply click the “Get Started” button to sign up for your own credentials, which will not be included in your license count with any other SPS services according to the current parameters of the program. Once you’ve accepted an offer, SPS will link your credit line to your business’s activities within SPS. Additionally, you can grant permission to selected team members who are more frequent SPS users to manage and advance invoices on your behalf.

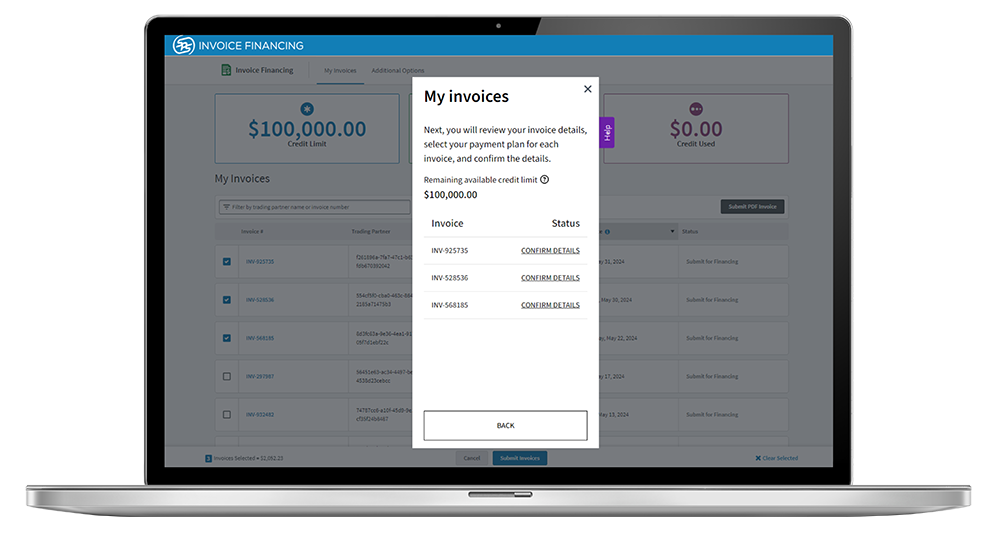

I only use SPS for a couple of my trading partners. Can I use this program for invoices I don’t generate through SPS?

Yes! After your credit line is active, you can submit valid PDF invoices that you’ve sent to other customers, even if they were not generated through SPS. This allows you to expand your financing options beyond SPS-generated invoices.

Once I’ve applied, when should I expect to receive my SPS Invoice Financing details?

Details of your invoice financing agreement, including your available credit limit and fees, are typically presented to you within one business day; however, in rare instances it can take up to three business days.

How do I repay an invoice advance?

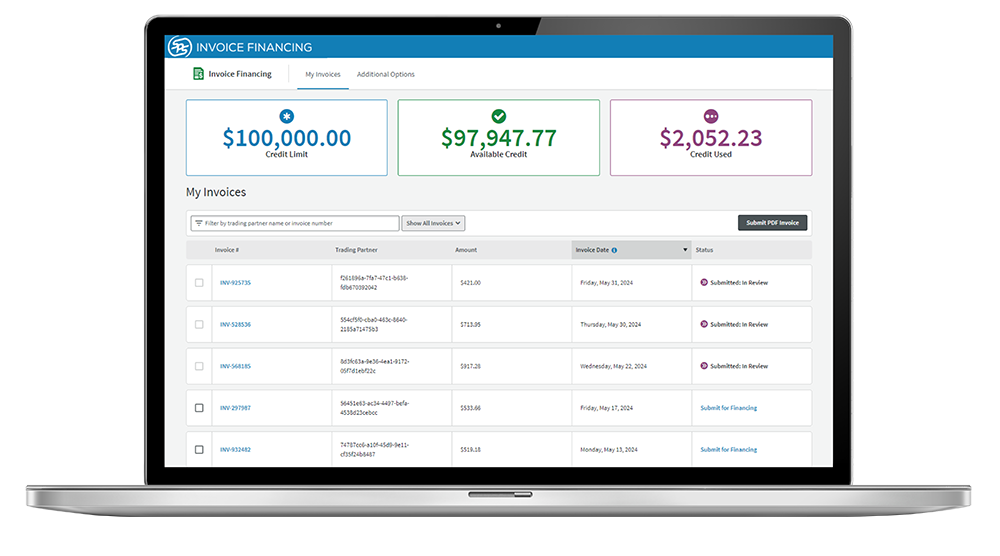

Repayment terms are determined upfront and are structured as fixed payments that are automatically deducted from your bank account. Each time you select an invoice to finance, you will have the option to select the duration of your repayment terms.

Can I repay an invoice advance early?

Yes! You can repay early without penalties.

How do I track my outstanding balance and payment history?

You can track your outstanding balance, payment history and other useful information in your funding portal on the SPS Commerce platform. This information will begin to update as soon as you receive your funds.

Are there any late fees?

Kanmon does charge a $25 fee for any late payment. Also, if a payment gets returned because of insufficient funds in your business bank account, Kanmon charges a separate $35 fee.

How does this differ from invoice factoring?

Invoice financing and factoring are both methods of obtaining funds based on outstanding invoices, but there are a couple of distinct differences. With factoring, you give up control over collecting payments from your customers, and the factor company takes over this task. This can sometimes lead to a less direct relationship with your clients, and they may be less inclined to pay promptly to a third party. Also, with factoring, you typically don’t have the option to select which invoices you would like to finance. It’s all or nothing.

With SPS Invoice Financing, you have total control over which individual invoices you want to get paid early on. You continue to collect payments from your retail trading partners, allowing you to preserve those valuable relationships. You have fast access to funds to support your growth, without giving up control over your business.

Why Kanmon?

SPS Commerce has chosen Kanmon as its trusted partner to help bring unique financial solutions to our valued customers. Kanmon provides relevant, cost-competitive financial solutions to help SPS Commerce customers grow and run their businesses more efficiently. Kanmon provides a streamlined, intuitive onboarding experience and serves financing offers back to qualified borrowers within 1-2 business days. Consider Kanmon the growth partner, hand-selected by SPS Commerce, to solve the unique challenges that business owners face today.

Kanmon is a licensed commercial lender founded by a team with deep lending experience and backed by FIS Global, a Fortune 500 financial technology business. For more information about Kanmon, visit www.kanmon.com.

SPS Commerce Invoice Financing is powered by Kanmon. All loans are subject to credit approval. Your terms may vary. SPS Commerce Invoice Financing loans are issued by Kanmon. Loans are made pursuant to a Department of Financial Protection and Innovation California Lenders Law License.

Read more about Kanmon here